Loans, especially online personal loans, help individuals during a cash crunch. They can help handle a medical emergency, debt consolidation, and meet various expenses, like home renovation, weddings, and many other personal expenses.

Any eligible individual can get quick funds with unsecured personal loans. But when it comes to taking a loan, borrowers should understand how it can affect their financial health, including their credit score. Any borrower’s current borrowing decisions can impact their future financial well-being.

This article will help us understand a loan’s positive and negative impacts on credit scores.

First, let us know about the credit or CIBIL score for a personal loan

What is a Credit Score, and How is it evaluated?

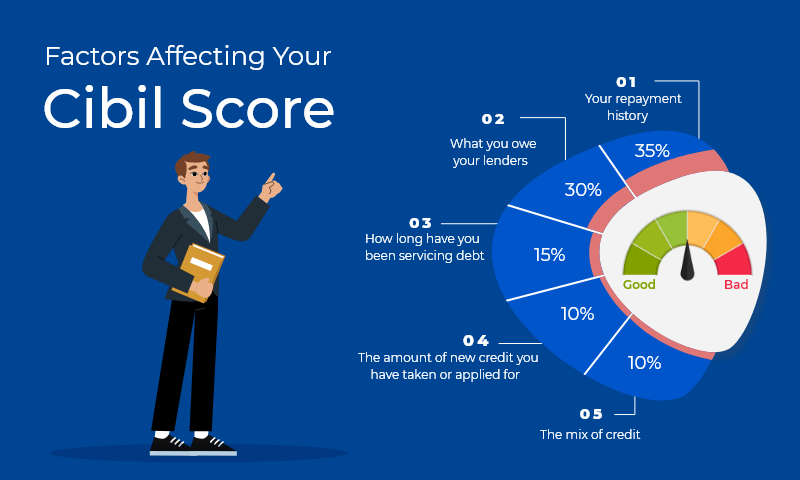

- A credit score describes a borrower’s creditworthiness in a three-digit number. In India, the lowest credit score is 300, and the highest is 900. CIBIL score is evaluated and assigned based on payment history (35%), debt-to-income ratio (30%), length of the credit history (15%), new credit (10%) and credit mix (10%).

- Credit bureaus, like TransUnion CIBIL, assign a credit score based on an individual’s discipline in handling their debts. These organisations maintain records of individuals’ credit information. An individual’s credit report consists of the entire history of their loans, credit cards, bill payments, loan repayments, and outstanding credit/loan balances. The credit score is considered to evaluate the borrower’s creditworthiness during the loan application process. A good credit score of 750+ is one of the primary requirements to secure a loan from lending institutions in the organised lending sector. A personal loan EMI calculator can help individuals to determine their eligibility for a loan based on various factors, including their credit score.

Positive Impacts of Loans on the Credit Score

-

Build a Credit History with an Instant Small Loan to Improve the Credit Score

When one takes a loan, it adds to their credit history. Credit bureaus consider an individual’s credit history while assigning a credit score. Personal loans are easy to avail in this world of digital lending. They help individuals to create a credit history and enhance their credit score.

-

Apply for a Loan with Suitable Repayment Tenure for an Increased Credit Score

A personal loan can help borrowers to establish a good track record with timely payments. Repayment history accounts for 35% of a credit score and is a key factor in calculating one’s credit score. Applying for a loan with a suitable repayment tenure helps borrowers make monthly payments on time. It ultimately strengthens borrowers’ creditworthiness and increases credit scores. Using an online personal loan EMI calculator is a good practice to know the EMI amount to be paid during the selected tenure beforehand.

-

Use Loan for Debt Consolidation

One of the factors considered while assigning the credit score include the debt-to-income (DTI) ratio. A low DTI ratio helps increase the credit score. Unsecured personal loans are offered without limitation on the end-usage of the loan amount. Individuals use these loans for debt consolidation, which ultimately helps decrease their total monthly repayment, reducing the DTI ratio. It can also help improve an individual’s credit score.

-

Take Advantage of Long Credit History that Improves Credit Score

A longer credit history helps to strengthen the credit profile and boost the credit score. Credit history accounts for 15% of a credit score. Credit bureaus consider the average length of credit/loan accounts. The longer the credit history, the better the CIBIL score for a personal loan.

Negative Impacts of Loan on Credit Score

Irresponsible use of a loan can hurt the credit score in the following ways:

-

Delayed EMIs of a Loan Hurts Credit Score

When individuals do not pay EMIs (Equated Monthly Instalments) on time, it indicates irresponsible behaviour. Since it is recorded in credit reports, it declines the credit score. It can cause a slight drop in one’s credit score in the short term. This impact can be nullified by making timely payments.

-

Many Hard Inquiries Declines Credit Score

The lender checks for their credit profile whenever an individual applies for a new loan. It is considered a hard inquiry. Every time a lender makes a hard inquiry, it is recorded in the borrower’s credit report and drops the score a bit. Multiple hard inquiries by an individual pull down the credit score.

Conclusion

Understanding the impacts of a personal loan is vital. Plan and manage the borrowings wisely to reduce the negative impacts on the credit score. The key is repaying the loan within the loan tenure. Also, borrowing funds after considering the current financial standing and taking steps to improve credit score if not eligible is a wise thing to do.

Also Read: Understanding Indemnity Insurance